For most people, buying a home is the biggest investment they’ll ever make. But what if you could own a small piece of something much bigger – a landmark even?

The global real estate market represents the world’s largest asset class, worth approximately USD228 trillion, making up more than half the value of all mainstream assets worldwide.

But only USD8.5 trillion worth of real estate (around 4 per cent) is traded every year, making bricks and mortar a very low liquidity asset class.

Illiquidity was one of the prime reasons that the global financial crisis hit so hard, with many real estate investors hit their risk limits when global property prices dropped in the 2008/09 period and they were forced to sell to negate further losses.

The global real estate market represents an important part of many institutional and large-scale investors’ portfolios because it provides stable and steady income and lower volatility. But the fact is, unless you’ve got very deep pockets, it’s out of reach for many.

What if there was a way to raise the liquidity of the real estate market? What if there was a lower cost way into the real estate market that provided real equality for investors?

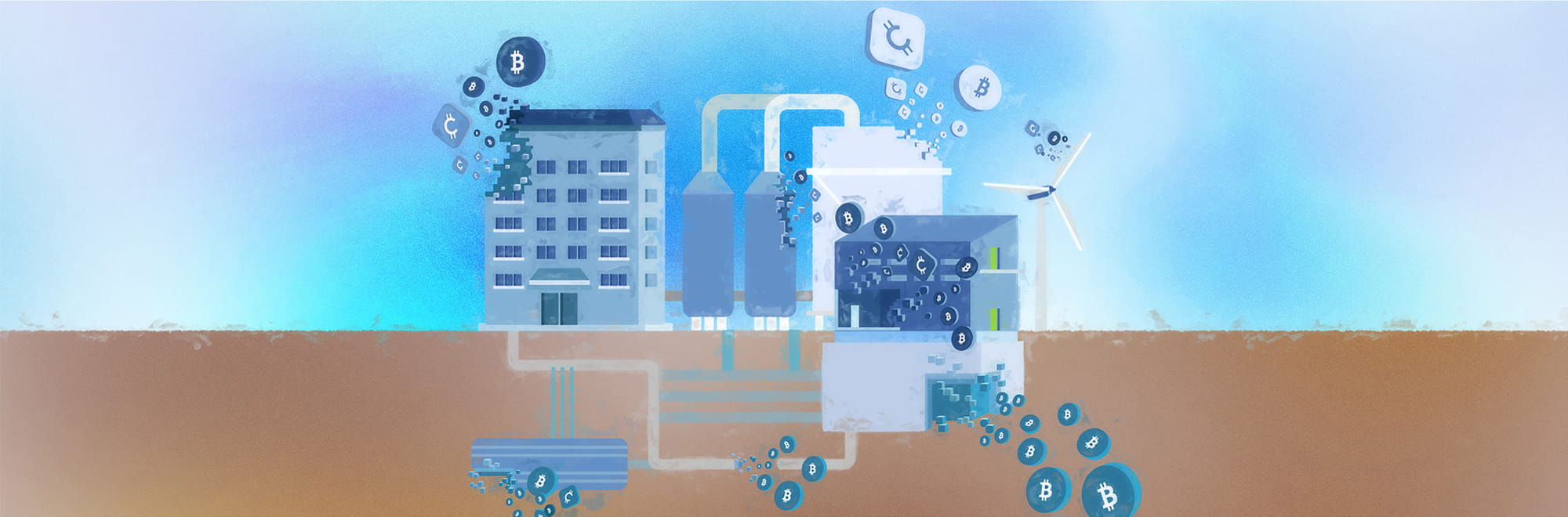

Blockchain technology and tokenisation may just be the answer. As the asset tokenisation market is expected to grow to USD24 trillion by 2027, the real estate industry is slowly being disrupted as well. How will our world and markets change as it becomes tokenised?

A game-changer

The idea of tokenising our assets and real estate may seem pretty out of this world, but we are getting closer to it than we think. Virtual real estate is currently gaining a lot of attention after the digital artwork ‘Mars House by Krista Kim’ sold for over $500 000 at an auction last year – and it’s continuing to rise.

Virtual worlds like Decentraland allow people to engage in the virtual world as they would do in the real one. They can hang out with friends, attend events, decorate their homes, rent places. Decentraland even has an ambitious plan to transform its Genesis City into a virtual metropolis, where users can “go to a casino, watch live music, attend a workshop, shop with friends,” or even start a business.

Just this year, Decentraland sold a patch of virtual land for more than $900 000 – the most expensive non-fungible token (NFT) land sold to date.

So, if people are getting around the idea of investing in virtual real estate through cryptocurrencies and NFTs, what if we apply it in actual and physical real estate?

Carving a slice of paradise

Currencies (be it dollars, pounds, yen or bitcoin) are fungible. That is to say that anyone can exchange their dollar for anyone else’s dollar in a 1-to-1 trade as every dollar has the same value.

NFTs are non-fungible insomuch as they are digital representations of a rare (or in many cases, unique) product. Through NFTs, creators have found a way to assign a monetary value to their non-fungible wares with a blockchain record acting as an immutable record of ownership – and a mechanism to transfer that ownership.

A growing number of platforms have performed essentially the reverse of this action. Breaking down non-fungible real estate into a series of fungible blocks, which convert the property value into digital tokens. These tokens, commonly referred to as ’security tokens’, offer buyers a share in real estate assets.

Essentially, this means that an asset valued at a million dollars can be converted into a million tokens and traded in a highly liquid manner in an open market. This way, a residential home (or office block, shopping mall, or even railway line, road, etc) could be owned by 50 – or indeed, 50 million – individuals.

One of these players is RealT, which has set out to remove the barriers of real estate investment and empower many to invest in a safe, secure environment.

This blockchain-based platform for real estate transactions uses smart contracts. It removes the barriers of real estate investment, aiming to shift to a new tokenised paradigm, essentially allowing investors from all over the world to own fractions of the same physical asset.

Tokenising assets

Make no mistake, the tokenisation of real estate assets has the ability to make the assets around us – from roads, to pipelines to buildings – a more liquid commodity class.

Breaking up real estate into fungible security tokens and selling off smaller increments of this asset class in this way will have big ramifications for larger infrastructure, such as government assets like ports and airports, which are being sold off around the country.

So, instead of trying to find a single buyer for a $20 billion asset, imagine having a way to sell this onto the market in the form of a non-fungible asset? It would be transformative.

Trading real estate ‘chunks’

Not only will it free up liquidity, there’s also significant investor benefit in terms of raising capital. Carving up bricks and mortar into fungible tokens and putting each one out for sale on the open market will substantially both increase transactions within the market and reduce the cost of each of those transactions

Trading real estate ‘chunks’ in this way will also provide a safer and more convenient way for all people to invest. After all, bricks and mortar has always been the safest investment tool of them all.

Greater liquidity across real estate asset classes would be a game changer. It would represent democratisation of investment, and there’s no doubting the role it will play in the future of investment – giving more people access to real estate, while giving developers access to a wider client base.

The key requirements for a new market segment to be born are a requirement from a series of end users (prospective investors), a requirement from the providers (developers, etc) and an enabling technology provided by an intermediary (in this case, platform providers utilising latest blockchain technology).

So, like all new concepts, the key to getting this concept mainstream comes down to finding like-minded developers and like-minded people – and connecting the dots. Imagine a world where there was no significant financial barrier to investing in the world’s largest asset class and unlocking its liquidity. It’s closer than we think.

This blog was authored by: Kevin Miller